PRE-HOMEOWNERSHIP CURRICULUM

Habitat Partner Family Program Manual

Dear Partner Family,

Congratulations for being selected to partner with Habitat for Humanity to build a home for you and your family. We are excited about this opportunity and look forward to working with you.

Every hour you contribute during this process is an investment in your future for you and your family. Whether that time is spent in a workshop, on site, helping out at our ReStore or meeting with volunteers, you and your family will be proud of the fact that you have a place to call home where you can welcome friends and family for years to come!

Volunteers, staff, donors and other Habitat families are here to support and cheer you on! Be sure to utilize their knowledge and excitement as questions arise. Each person wants to help you accomplish the wonderful thrill of owning your own home! You have worked hard to get this far and we are proud of you for going after your dream- by working together, we will build you a home!

This Homeowner’s Manual will help guide you through the overall process of becoming a Habitat Homeowner and will be a good resource for you when you need information regarding sweat equity, the construction process, documents and what to expect once you move in.

The path towards homeownership through Habitat is a path of breakthroughs and vulnerable moments. We are honored to share this journey with you.

DeeDee & Catalina

Habitat Homeowner Services

Homeownership@brhabitat.org

541-385-5387

“Vulnerability is the birthplace of love, belonging, joy, courage, empathy, and creativity. It is the source of hope, empathy, accountability, and authenticity. If we want greater clarity in our purpose or deeper and more meaningful spiritual lives, vulnerability is the path.” Brené Brown

Habitat for Humanity International has more than 1,300 local affiliates in the United States and more than 70 national organizations around the world. Together, we have helped to build or repair more than 800,000 houses and serve more than 4 million people worldwide.

Habitat for Humanity International was founded in 1976 by Millard and Linda Fuller with the vision of a world in which everyone has a decent place to live. For more information, check out www.habitat.org.

The following Sections are a compilation of the Habitat Program Overview Responsibilities and Requirements. Each adult in the family must read each section, complete and turn in the section Assignments, preferably in the order suggested by the tab number. Even though we understand everyone has a different pace in tackling the work, our experience shows that one assignment per month is a good pace to keep engagement high and enough to maintain life balance. The time you dedicate to reading and completing the assignment is tallied with other activities for a grand total of 50 hours.

Any questions, do not hesitate to contact us: homeownership@brhabitat.org or call 541-385-5387

What is Sweat Equity?

Sweat equity is Habitat’s most valuable tool in building the partnership between partner families and affiliate stakeholders. The term refers to the actual hands-on involvement of Habitat partner families in the construction of their own homes, as well as participation in other Habitat activities.

Sweat equity represents a partner family’s physical and emotional investment in the mission of Habitat and is designed to meet three important goals:

- Partnership: Sweat equity provides meaningful interaction between homeowners, affiliate representatives, and Habitat volunteers. Habitat for Humanity is not only about building houses; our mission extends to uplifting individuals and families and building community. The best way for partner families and volunteers to get to know one another is to work alongside each other.

- Pride in Ownership: Habitat is not a charity or a give-away program. We offer a hand up rather than a handout. Habitat works with, rather than for, individuals and families in need to build their own homes and a brighter future. By working on their own homes, partner families get full ownership of the home ownership process.

- Development of Skills and Knowledge: On the build site, partner families should gain a real understanding of the construction of their home and of maintenance issues they will face after occupancy. Through required education classes, partner families will gain skills that will be useful throughout their lives.

NOTE: Sweat equity should not and will not be assigned a dollar value. If a partner family is deselected or otherwise unexpectedly terminate the partnership before purchasing the home, they will not be compensated in any way for sweat equity hours performed.

You will be introduced to how to sign up for many of these hours at your Volunteer Orientation where you will learn about Volunteer Hub.

Opportunities for Sweat Equity

Sweat equity may include:

- Working on the construction sites

- Volunteering at the ReStore

- Raising funds and other public relations activities and events

- Classes and workshops as required by Habitat

Sweat Equity Hours will be expected in the following manner:

40 hours @ Construction (reserved 8 hours for your own home) Tracked through Volunteer Hub

35 hours @ Restore Tracked through Volunteer Hub

25 hours @ Events Tracked through Volunteer Hub

50 hours @ Other* = Classes (includes NeighborImpact), mandatory meetings, budget reviews, spending tracking, transportation, etc.

= 150 hours per adult (18 years and older) in the household

*Other (50) hours are awarded when all classes and requirements are complete. To track hours you will be required to submit the 50 hour sweat equity credit log monthly.

+ 100 Donated hours per household

Donated hours: A minimum of 100 hours can be contributed toward your sweat equity by other people such as family, friends, co-workers, etc.

At least 50% of donated hours should be by new volunteers to Habitat. So, invite your co-workers, extended family and friends!

In summary, the sweat equity requirement per household size is:

Single adult family: 150 hours of sweat equity + 100 hours donated

2 adult family: 300 hours sweat equity + 100 hours donated

3 adult family: 450 hours sweat equity + 100 hours donated

Children Hours

Your children can be involved in the sweat equity process too, however, it is not a requirement.

The maximum amount of hours that can be contributed by children to family hours per household is 20 hours.

Children at the Job Site:

- Children 16 years and older are allowed to work and be on the work site during construction without guardian supervision with a signed “Volunteer waiver” by parent/guardian. Note: No children under 16 years of age are allowed on site while the parent(s) are performing sweat equity hours.

- Children under 16: Examples of hours that may count toward sweat equity hours include:

- Writing thank you letters or cards

- Assist with landscaping days or office clean up

- Report Cards/Grades:

- Submitting Report Cards (A=3 hours, B=2 hours, C=1 hour)

- For elementary school age students, per report card: 4 E’s = 3 hours; 5 S’s = 3 hours, 3 5’s = 3 hours; 5 4’s = 3 hours. And, because making an improvement is important, an N to an S or E from one report card to the next = 2 hours.

|

● E – Exceeds expectations ● S – Meets expectations ● N – Needs improvement ● X – Consistently demonstrates |

● Performance levels: 1-5 ● Proficient – 4 ● Advanced- 5

|

Minimum Monthly Sweat Equity Requirement

Each adult (over 18 years of age) in the household will be required to complete a minimum of 8 hours of sweat equity per month until their hours are completed. These hours will only come from VolunteerHub scheduled activities.

Partner Families will also be required to work a minimum of 8 sweat equity hours on their assigned home. This can include construction, greeting volunteers on site, site prep and clean up, and the final home inspection before move-in date.

Getting Started with your Sweat Equity Hours

Attend a Volunteer Orientation, usually held weekly at the Habitat main office, or one that might be scheduled specifically for Partner Families.

Contact the Volunteer Coordinator at 541-312-6709 to attend.

You will be introduced to the online volunteer sign up system, as well as given a tracking log for occasional hours that will be recorded and turned in monthly.

Strike System

In order to ensure that Partner Families complete their obligations and abide by Habitat program policies and procedures in a timely, fair, and efficient manner, Habitat for Humanity has implemented a Three-strike system.

First Strike

- You will receive a letter sent as a warning, pointing out the area(s) in which you have failed to meet your responsibilities under program guidelines as outlined in the Partnership Agreement.

Second Strike

- You will receive a second letter as a more severe warning that you have once again failed to meet your responsibilities.

- Prior to scheduling further sweat equity opportunities, you MUST meet with a member of the Homeowner Services Department to discuss your ability to move forward in the partnership program.

- At this point, you may need to assess your own level of commitment and ability to successfully complete the partnership program. If you feel that you cannot get back on track for any reason, you have the option of voluntarily withdrawing.

Third (and last) Strike

- You will receive a third strike letter advising that you have failed to meet your obligations under the program guidelines. Upon your third strike, the Homeowner Services Department Staff will formally recommend to the Homeowner Selection Committee that you be deselected from the partnership program. You will be given an opportunity to write a letter of objection to the deselection that will be presented to the Homeowner Selection Committee prior to their vote. The decision of the Homeowner Selection Committee will be final.

Offenses that Lead to Strikes

- Failure to complete the 8 hour minimum monthly requirement of sweat equity.

- Failure to complete the 8 hour minimum sweat equity requirement on assigned home.

- Repeated failure to show up for scheduled work at a construction site, Habitat events or ReStore.

- Not adhering to the volunteer code of conduct

- Failure to attend or arriving late for scheduled meetings with Habitat staff without prior notification.

- Failure to update your contact information with Habitat when you have a change in phone number, address, and/or email address, resulting in staff having difficulty reaching you when needed.

- Failure to reply to communications (email, calls, texts) in a timely manner

Deselection

Habitat is strongly committed to the relationship between the organization and the Partner Family. The goal of Habitat is to work in partnership with the Partner Family and to prepare the Partner Family for successful home ownership. In the spirit of mutual cooperation, the Partner Family also has significant responsibilities and is expected to take the role seriously. If certain criteria are not met, it will be seen as lack of willingness to partner and could result in termination of the partnership (deselection).

According to Habitat for Humanity International, “deselection” is defined as “terminating the partnership between the time of board approval and the closing/occupancy of the home”.

Grounds for deselection include:

- Fraud or misrepresentation of material facts or information during the application process or after selection.

- “Failure to Partner” by failing to complete the requirements outlined in the “Partnership Agreement” (see sample by following this link)

- Negative change in financial circumstances that would significantly impact ability to pay.

- -5% income decrease from reported household income at time of program application

- Becoming unemployed while in the program: The family will have one year to regain qualified income through acceptable sources of income or benefits. After one year, if adequate income has not been secured, the Partner Family will be de-selected but all sweat equity hours will be saved for up to two years.

- Presence on a sexual offender database.

- Conduct not aligned with the Habitat Volunteer Conduct Agreement/ Volunteer Waiver

Prospective homeowners may also choose to deselect themselves at any point during the home-ownership process.

Should you re-apply for the program, your sweat equity hours will be saved for 24 months.

Matched Savings Program

Partner Families need to apply for an Individual Development Account (IDA) offered through NeighborImpact.

Note: the application process to be approved for the Matched Savings account can take 4 weeks.

This is a matched savings program that allows partner families to save money to cover their closing costs. These programs will match your savings, 3-1. Partner Families will be required to attend financial classes as required by these programs. These classes will provide helpful information regarding credit cards, loans, budgeting, home maintenance, lending, and other important information pertaining to home ownership. Habitat for Humanity partners with NeighborImpact to fulfill this requirement.

Classes consist of 4 financial planning courses at 1.5 hours each, and one 8-hour homeownership course.

- Financial Planning & Money Management

- Saving & Investing

- Financial Institutions, Taxes & Insurance

- Understanding & Managing Credit

- HUD approved Homebuyer Course

Note: Even if you do not qualify or if there are no funds available to participate in the matched savings program, you will be required to attend the courses. As a Habitat partner family, you can apply for a scholarship towards the Financial Fitness Classes. The 8-hour Homebuyer course has a higher fee per household. Habitat will reimburse you for up to $45.

Savings Account Contact Information:

NeighborImpact, Individual Development Account (IDA) – (541)318-7506.

Once approved and enrolled in the savings program, Partner Families are responsible for turning in a copy of their account statement to the Family Services Department each month.

What should be my savings goal for the matched savings account?

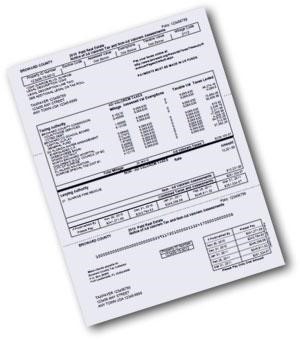

You should aim to cover as much of the closing costs of your home as possible. Closing costs are one-time fees that you, the homebuyer, will be required to pay at the closing of escrow.

Approximate Closing Costs:

$2,800 One year of Property Taxes

$500 One year of Homeowners Insurance

$600 Two months “cushion”

$900 Application Fee (State Bond Program)

$3000-4000 Points (1.5% of loan)

$500 Closing cost fees

Total: $8,300-9,300

How Much Do I Need to Save?

You will need to save approximately $2,000 per household. (You will be matched three times the amount you save).

- The minimum amount of time to receive a match is 6 months + 1 day, from 6 months to less than 12 months, the maximum savings matched is $1,000 – receiving $3,000.

- From 12 months + 1 day, maximum savings match is $2,000 – receiving $6,000.

- After 24 months +1 day, maximum savings match $3,000 – receiving $9,000

Even if you do not participate in the matched savings program, you are expected to save at least $2,000 (and make monthly deposits toward this amount).

Timely Need for Income verification

Because your mortgage payment is based on your gross income at time of credit/home loan application, we will need quarterly submission of your pay stubs/income verification or PNL report if you are self-employed. See the annual calendar for these dates.

The logging sheet for accruing the additional 50 hours should be turned in between the end of the month and before the 10th of the following month. Please ask staff for additional copies if needed or download your copy here.

Homeowner Education Meetings

These monthly meetings are designed to bring Partner Families together in order to share important information and cover topics related to Habitat homeownership. You will receive a schedule of these meetings in advance and attendance is required.

Partner Families are responsible for turning in their “other” sweat equity report, assignments and monthly budget prior to the 10th of the following month.

Failure to notify Habitat staff in advance if you are unable to attend a meeting may result in a strike. These meetings and classes are separate from the ones you will attend at NeighborImpact as a part of your matched savings agreement.

All classes and meetings count toward sweat equity time and this time will be awarded to you after all requirements have been met.

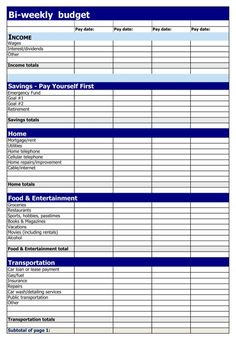

Each month you will be expected to turn in the following to the Homeowner Services Department:

- Budget (we have provided you with a copy of the budget form you should use while you are in the program, to download click here)

- “Other” Sweat Equity Time sheet

- Savings Account Statement or deposit slip

Pay stubs (or verification of income such as Profit and Loss statement) will be required quarterly (see your annual education calendar)

Please download the Assignment to be able to save after completing. You can either print and submit in person to Habitat Homeownership Staff or, email as an attachment to homeownership@brhabitat.org

Click to Open & Download Assignment One![]()

You will need a paper and pen/pencil in order to read through this article

Discover Your Personal Core Values

Most of us don’t know our values. We don’t understand what’s most important to us. Instead, we focus on what society, culture, and media, value.

Can you articulate the top 5 to 10 values that are most important to you?

Without undergoing a discovery process, it’s challenging to identify your personal core values. It’s easy to speculate and idealize what you should value. But knowing and accepting what you value, takes effort.

STEP 1: Start with a Beginner’s Mind

It’s too easy to presume that we know the answer at the start and to, therefore, never embark on a creative, personal discovery process.

Adopt the mind of a beginner—someone with no preconceived notions of what is—to give you access to inner truths to which your conscious mind is yet unaware. Take a deep breath and empty your mind. Remember that your conscious mind doesn’t have all the answers. Create a space for new insights and revelations to emerge. Getting in right mental and emotional state is an essential first step.

STEP 2: Create Your List of Personal Values

Arriving at a concise and short list of personal values can be a daunting task. You can find lists online with almost 400 values to choose from. However, it is best if you can come up with your own first. Values are best discovered and revealed. If you start with a list, your conscious mind will test which values appear “better” than others. That said, if you’re not familiar with working with values, you can scan a list of values (below, at end of this section) to get a sense of your range of options.

To help you uncover your own personal core values, here are three processes you can try:

1) Peak Experiences

- Consider a meaningful moment—a peak experience that stands out.

- What was happening to you?

- What was going on?

- What values were you honoring at this time?

2) Suppressed Values

- Now, go in the opposite direction; consider a time when you got angry, frustrated, or upset.

- What was going on? What were you feeling? Now flip those feelings around.

- What value is being suppressed?

3) Code of Conduct

- What’s most important in your life? Beyond your basic human needs, what must you have in your life to experience fulfillment?

- Creative self-expression? A strong level of health and vitality? A sense of excitement and adventure? Surrounded by beauty? Always learning?

- What are the personal values you must honor or a part of you withers?

My initial Values List: (write on a piece of paper)

STEP 3: Chunk Your Personal Values into Related Groups

Combining all the answers from step 2, you now have a master list of personal values. Maybe there are between 20 and 40 values on your list. That’s too many to be actionable.

Your next step is to group these values under related themes. Values like accountability, responsibility, and timeliness are all related. Values like learning, growth, and development relate to each other. Connection, belonging, and intimacy are related too. Group them together.

My Related Values: (write on a piece of paper)

STEP 4: Highlight the Central Theme of Each Value Group

If you have a group of values that include honesty, transparency, integrity, candor, directness, and truth, select a word that best represents the group.

For example, integrity might work as a central theme for the values listed above. You can keep the other words in the group in parentheses to give your primary value more context. You’ll use them again in step 6.

Central Themes for my values are: (write on a piece of paper)

STEP 5: Determine Your Top Personal Core Values (5-10)

Now comes the hardest part. After completing step 4, you still may have a sizable list of values. Here are a few questions to help you whittle your list down:

- What values are essential to your life?

- What values represent your primary way of being?

- What values are essential to supporting your inner self?

As a unique individual, you possess certain strengths and weaknesses. Your values matter most to you. How many core values should you end up with? Too few and you won’t capture all the unique dimensions of your being. Too many and you’ll forget them or won’t take advantage of them. While the number of core values differs for each person, the magic range seems to be between 5 and 10.

Rank them in the order of importance. This is often the most challenging part.

You may need to do this step in multiple sittings.

After doing one round of ranking put it aside and “sleep on it.” Revisit your ranking the next day and see how it sits with you. Then, go through the process again.

My 5-10 Core Values in order of Importance are: (using the list of possible values below, write down the value that you consider high on your list, on a piece of paper)

List of possible Values by category

- Integrity

- Accountability, Candor, Commitment, Dependability, Dignity, Honesty, Honor, Responsibility, Sincerity, Transparency, Trust, Trustworthy, Truth

- Feelings

- Acceptance, Comfort, Compassion, Contentment, Empathy, Grace

- Achievement

- Accomplishment, Capable, Challenge, Challenge ,Competence, Credibility, Determination, Development, Drive, Effectiveness, Empower, Endurance, Excellence, Famous, Greatness, Growth, Hard work, Improvement, Influence, Intensity, Leadership, Mastery, Motivation, Performance, Persistence, Potential, Power, Productivity, Professionalism, Prosperity, Recognition, Results-oriented, Risk, Significance, Skill, Skillfulness, Status, Success, Talent, Victory, Wealth, Winning

- Intelligence

- Brilliance, Clever, Common sense, Decisiveness, Foresight, Genius, Insightful, Knowledge, Learning, Logic, Openness, Realistic, Reason, Reflective, Smart, Thoughtful, Understanding, Vision, Wisdom, Gratitude, Happiness, Hope, Inspiring, Irreverent, Joy, Kindness, Love, Optimism, Passion, Peace, Poise, Respect, Reverence, Satisfaction, Serenity, Thankful, Tranquility, Welcoming

- Spirituality

- Adaptability, Altruism, Balance, Charity, Communication, Community, Connection, Consciousness, Contribution, Cooperation, Courtesy, Devotion, Equality, Ethical, Fairness, Family, Fidelity, Friendship, Generosity, Giving, Goodness, Harmony, Humility, Loyalty, Maturity, Meaning, Selfless, Sensitivity, Service, Sharing, Spirit, Stewardship, Support, Sustainability, Teamwork, Tolerance, Unity

- Creativity

- Creation, Curiosity, Discovery, Exploration, Expressive, Imagination, Uniqueness, Wonder, Innovation, Inquisitive, Intuitive, Openness, Originality

- Strength

- Ambition, Assertiveness, Boldness, Confidence, Dedication, Discipline, Ferocious, Fortitude, Persistence, Power, Restraint, Rigor, Self-reliance, Temperance, Toughness, Vigor, Will

- Freedom

- Independence, Individuality, Liberty

- Courage

- Bravery, Conviction, Fearless, Valor

- Order

- Accuracy, Careful, Certainty, Cleanliness, Consistency, Control, Decisive, Economy, Justice

- Enjoyment

- Amusement, Enthusiasm, Experience, Fun, Playfulness, Recreation, Spontaneous, Surprise

- Presence

- Alertness, Attentive, Awareness, Beauty, Calm, Clear, Concentration, Focus, Silence, Simplicity, Solitude, Lawful, Moderation, Organization, Security, Stability, Structure, Thorough, Timeliness

- Health

- Energy, Vitality

3. BUILDING YOUR NET WORTH AND AVOIDING DEBT

3.1 Ways to Get Money

Should I Borrow Money?

Just because you can, doesn’t mean you should. The adage is as true for borrowing money as it is for poking yourself in the eye with a sharp stick. But, unlike eye poking, which has few benefits, borrowing has good points and bad.

“Borrowing where you are not overextending yourself is good borrowing,” says Patricia Hasson, president of Consumer Credit Counseling Services of Delaware Valley.

“Bad borrowing is borrowing at a very high percentage rate. If you are borrowing and paying 18 percent interest, you have to evaluate whether it is worth it,” she says.

Anyone can become a bad borrower using almost any available instrument. But some products lend themselves to bad borrowing more readily due to fairly egregious terms and conditions. Keep in mind, though, that the potential for abuse and misuse exists with just about all loans.

Loan Types:

Payday loans

Watch the 10 minute video at: https://www.youtube.com/watch?v=BHTMuHvmarU

Car title loans

Watch the 4-minute video at: https://www.youtube.com/watch?v=Xr9vSWVXR2M

Tax refund anticipation loans

Watch the 2-minute video at https://www.youtube.com/watch?v=2IVOL_iy3ZQ

3.2 Co-signing a loan

You may already have a mortgage, a car loan and credit card bills of your own, but co-signing will let you enjoy all the responsibility of another financial obligation with none of the benefits.

“If you’re helping someone, probably one of your children, establish credit and you are comfortable in their ability to pay, then it might be OK,” says Patricia Hasson, president of Consumer Counseling Services of Delaware Valley.

“I would make sure that I had enough room in my budget to pay it,” she says.

If you can get one of your worst enemies to co-sign a loan for you, then it may one of the best ways to get revenge. All too often co-signers find themselves left holding the bag long after the other person on the loan has stopped paying it due to other more pressing debt obligations.

3.3 Other Types of Predatory Lending Practices

While there is some dispute about what constitutes a predatory lending practice, a number of actions are often cited as such — including a failure to disclose information or disclosing false information, risk-based pricing and inflated charges and fees. There are other predatory practices such as loan packing, loan flipping, asset-based lending and reverse redlining.

These practices, either individually or in concert with each other, create a cycle of debt that causes severe financial hardship on families and individuals.

- Inadequate or False Disclosure

The lender hides or misrepresents the true costs, risks and/or appropriateness of a loan’s terms, or the lender changes the loan terms after the initial offer.

- Risk-Based Pricing

While all lenders depend on some form of risk-based pricing — tying interest rates to credit history — predatory lenders abuse the practice by charging very high interest rates to high-risk borrowers who are most likely to default.

- Inflated Fees and Charges

Fees and costs (e.g., appraisals, closing costs, document preparation fees) are much higher than those charged by reputable lenders, and are often hidden in fine print.

- Loan Packing

Unnecessary products like credit insurance — which pays off the loan if a homebuyer dies — are added into the cost of a loan.

- Loan Flipping

The lender encourages a borrower to refinance an existing loan into a larger one with a higher interest rate and additional fees.

- Asset-Based Lending

Borrowers are encouraged to borrow more than they should when a lender offers a refinance loan based on their amount of home equity, rather than on their income or ability to repay.

- Reverse Redlining

The lender targets limited-resource neighborhoods that conventional banks may shy away from. Everyone in the neighborhood is charged higher rates to borrow money, regardless of credit history, income or ability to repay.

- Balloon Mortgages

A borrower is convinced to refinance a mortgage with one that has lower payments upfront but excessive (balloon) payments later in the loan term. When the balloon payments cannot be met, the lender helps to refinance again with another high-interest, high-fee loan.

- Negative Amortization

This occurs when a monthly loan payment is too small to cover even the interest, which gets added to the unpaid balance. It can result in a borrower owing substantially more than the original amount borrowed.

- Abnormal Prepayment Penalties

A borrower who tries to refinance a home loan with one that offers better terms can be assessed an abusive prepayment penalty for paying off the original loan early. Up to 80% of subprime mortgages have abnormally high prepayment penalties.

- Mandatory Arbitration

The lender adds language to a loan contract making it illegal for a borrower to take future legal action for fraud or misrepresentation. The only option, then, for an abused borrower is arbitration, which generally puts the borrower at a disadvantage.

Click to open & download assignment 3One of the best ways to be successful with your money is to know where your money goes each month. Many people fall into financial trouble but don’t understand why. This is because they miss the basic financial management principle of budgeting.Making a budget and tracking your spending can feel a bit like having strict parents and, it seems like your budget starts by telling you what to do. Then your spend-tracking sheet comes along to shame you or punish you when you don’t follow your budget.However, this perception of budgeting and tracking spending is misguided: Creating a budget actually gives you freedom.

A budget gives you the freedom to tailor your current spending practices as you see fit. It helps you adjust them in a way that ensures you are managing your money in line with your financial goals. In this section you will learn quick guidelines to prepare your own category budget, according to your lifestyle.

Monthly Budget Percentages by Category

Your budgeting percentages may vary from these suggestions due to the size of your family. The area you live in (cost of living varies from city to city) and what your financial goals are will have an impact too. These are percentages of your net or take-home income. Remember that it’s important to tailor your budget to fit you/your family’s personal needs and lifestyle.

How to calculate the percentage: Add up the category total and divide by your monthly net (take-home) income then multiply by 100 to get the percentage.

For example, Jan spent $450 on groceries and her monthly net income is $2,800 then $450/$2800 = .1607 x 100 = 16.07%. A little high, Jan.

Now, let’s do a little practice – using the budget wheel below complete assignment 4. Don’t forget to save the pdf to your computer in order to email or print upon completion.

If you want to win with money, you have to change your actions with money. The way you do that is to make a budget and then stick to it. The way you do that is to track your expenses. Maybe this is new terminology for you—but don’t be intimidated. We can give you the information you need to move forward in your money journey (with confidence!) while moving away from whatever’s been holding you back.

Steps to Track Your Expenses

Adapted from Everydollar.com – We liked the way they use layman terms to make budgeting fun and applicable. They will promote their app use down below, there are many apps available to track your expenses, so we think it is harmless to just take a look at what they offer. Lets keep going!

Step 1: Create a Budget

You won’t be able to track expenses without one. What’s a budget? It’s your monthly money plan—your expected income and expenses put in categories for the whole month.

A budget doesn’t control you; YOU control it. It’s a guide you set up to make sure your money is doing what you’re telling it to do.

There are three basic steps to setting up a budget:

- Write down your monthly income.

- Write out your monthly expenses.

- Start with food, shelter (your mortgage or rent plus utilities), clothing, and transportation.

- Once those are covered, list out all other expenses like entertainment, eating out, pan flute lessons, television streaming services, gym memberships, giving, saving, etc.

- If you’re new to budgeting and not sure where to start, check out our recommended budget percentages.

- Make sure your income minus your expenses equals zero.

- If the math doesn’t work out, you need to adjust your categories until you get that zero-based budget.

We could talk about tips for setting up budgets all day long, but that’s a quick summary.

Step 2: Record Your Expenses

This action is key in communicating to your partner and yourself what money is left to use in all those categories you set up through step one. And that brings us to the next step.

Step 3: Watch Those Amounts

Tracking your expenses can help make sure you don’t overspend in any area. When you enter an expense, make sure you keep track of how much is left in that category.

If you’re married, make sure both of you are recording all spending and checking in with each other before you spend. This is great for accountability and communication. That way neither one of you will ever say, “I didn’t know you spent most of the entertainment budget buying tickets to the wax museum. I wanted to sign us up for a couple’s beatbox class.”

Budgets are blown when you don’t track and watch your expenses.

Four Ways to Track Your Expenses

![]()

Pencil & Paper

Don’t dismiss old school methods. Plenty of people have and still do stick to a paper budget. The biggest benefit here (besides not needing access to technology) is that physically writing things down requires an active brain. Active brains are really quite helpful when you’re dealing with money.

The inferior side to this method is pretty clear: Most of us don’t keep up with paper copies of stuff these days. When you get a receipt, you have to hold on to it until you can get it to your budget and write it down. Sometimes receipts are misplaced. Sometimes the cash you spent on a quick trip to the dollar store is forgotten. Sometimes a few debit card purchases aren’t written down quickly by one spouse or the other. Any of these communication breakdowns can lead to a busted budget.

Envelope System

This expense tracking method is set up a “pay cash in person” method. You can auto draft things like retirement, mortgage and some utilities. You might send checks or make a debit card payment online for other bills. But the expenses you pay for in person become cash only.

At the start of the month, you put cash in envelopes labeled with budget lines. Groceries, entertainment and eating out are three great examples. Take your “groceries” envelope with you when you head to the grocery store. When the envelope is empty, your spending stops. Your money is essentially tracking itself.

Let’s face it, though, paying in cash can sometimes be inconvenient. Who wants to go inside the gas station to prepay at the register? Who likes counting out or keeping up with coins? Plus, with the rise of e-commerce, paying cash isn’t always an option. Still, this is a powerful way to track expenses, because physically watching the money leave the envelope inspires a whole new level of responsibility.

Computer Spreadsheets

It’s time to talk digital. Plenty of people are spreadsheet fanatics, and they’ll talk to you about its perks until the end of time. The plethora of templates, the ability to customize your budget, the beauty of having the math done for you on the screen—these are a few benefits to spreadsheet budgets.

But those spreadsheet enthusiasts aren’t always married to fellow spreadsheet enthusiasts. Couples should be in open communication about their spending; don’t let spreadsheets come between your happily ever after.

The second disadvantage to spreadsheets is getting to your computer to keep up with your spending. If you grow lax on these daily visits to enter expenses, your budget isn’t really a budget—it’s just a spreadsheet full of good intentions. Good intentions are where you start, but good intentions don’t accomplish money goals on their own.

You probably spend a fair amount of time on your computer, so maybe you think spreadsheets will work for you. But you know what’s always by your side? Your phone. Which brings us to the next—and, we boldly declare, BEST—option for tracking your expenses. Drum roll, please.

Budgeting Apps (This is the part where EveryDollar sells their app, just click to see if you find this option suitable)

Like, EveryDollar. With this free budget app, you can create a budget in minutes. You can log in on your phone and track the expenses mere moments after they occur. Don’t leave the parking lot of the dollar store without recording that you spent $3 and tax on a birthday balloon, gift bag and stuffed clownfish you hope your toddler niece will think is Nemo.

As you can see, the convenience of a budgeting app is its greatest asset.

Of course, EveryDollar boasts even more. Customize your templates to make them fit your spending and saving needs. Set up funds to meet big money goals. And sync your budget with your partner’s devices, so you guys are in constant commerce communication.

The two things to keep in mind with a budgeting app both stem from one key word: consistency. If you know you’ll forget to add in your spending, we can help. Some apps can link to your bank account and stream your transactions for you. All you do is drag and drop your expenses to the correct categories. Some people feel completely comfortable sharing their banking information through the internet, some prefer never do that. You do what works for you and your family.

No matter the method, you have to make tracking your expenses a habit to win with money. If you aren’t watching where your money is going, you’ll always be wondering where it went. But when you set yourself up with the right tools and know the work is worth it (which we totally verify from personal experience), you’ll move beyond good intentions into financial victories.

QUICK 5 TIP SELF CHECK-IN

- Have you filled in your net income and expenses completely?

- If self-employed:

-

- Are you using a Profit and Loss statement? If not, click here to download PNL template

- Do you have a separate bank account for your business? Let Homeowner Services staff know if you need some coaching in this area.

3. Is there an excess or shortfall in cash at month end? If so,

“Do you feel you could be setting aside more into your savings each month?”

-

- “Are there any variable expenses that you would like to adjust?”

4. If money always seems tight (or short) each month ask yourself:

“Have you ever done a cash flow budget?” Ask Homeowner Services staff for training and samples, if needed. Or click here to download.

5. Did you take a close look at your bank account statements when tracking your monthly expenses?

-

- Did you notice excessive bank account charges or banking fees?

Do you understand how to read your pay stub?

If not, click watch the “What the Heck! Pay Check?” Video © First Federal Bank of Kansas City

Here are four steps you can apply to any financial goal setting exercise:

Step 1: Identify and write down your financial goals, whether they are saving to send your kids to college or University, buying a new car, saving for a down payment on a house, going on vacation, paying off credit card debt, or planning for you and your spouse’s retirement.

Step 2: Break each financial goal down into several short-term (less than 1 year), medium-term (1 to 3 years) and long-term (5 years or more) goals; which will make this process easier.

Step 3: Educate yourself and do your research. Read Money magazine or a book about investing, or surf the Internet’s investment websites.

Step 4: Evaluate your progress as often as needed. Review your progress monthly, quarterly, or at any other interval you feel comfortable with, but at least semi-annually, to determine if your program is working.

If you’re not making a satisfactory amount of progress on a particular goal, re-evaluate your approach and make changes as necessary.

Sometimes when people write down their goals, they discover that some of the goals are too broad in meaning and nearly impossible to reach, while others may seem smaller in scope and easier to achieve. Break your goals down into three separate time categories.

By placing a time frame on your goals you are motivating yourself to get started and helping to allow you the chance to succeed.

Just remember that you can adjust the time frame whenever you want to.

Long-term goals (over 5 years) are those things that won’t happen overnight, no matter how hard you work to achieve them. They may take a long time to accomplish (hence the reason they are called long term goals), so give yourself a reasonable amount of time, that is based on your best estimates of what it will take to achieve them.

Examples of long-term goals might include college education for a child, retirement plan or purchasing a home. Whatever the case, these goals generally require longer commitments and often more money in the end.

Intermediate-term goals (1-5 years) are the type of goals that can’t be executed overnight but might not take many years to accomplish. Examples might include purchasing/replacing a car, getting an education or certification, or paying off your debts like credit cards etc. (depending on the amount).

Short-term goals (within one year) generally take one year or less to achieve, based on the date the task is needed, the total estimated cost, and the required savings.

What are your goals?

To find out, you need to make up a list, decide which timeline your goal fits into, detail the steps necessary to achieve your goals, then take action toward reaching those goals. It’s that simple.

You might be wondering where to start with your financial goal setting plan. These are some basic tips to help you in making the best choices for you.

After looking at these tips, it is best for you to go out and do some research to find the method(s) that suit you best.

- Begin by taking 5%-10% out of each paycheck and put it in a savings account

- Look into different investment strategies such as IRA’s, stocks, RRSP’s, mutual Funds, personal investments etc. There are many more and all can assist you in short and long term goals.

- Start making a budget for yourself that leaves you with some extra money and follow it

- Use your coupons; that is why they are there. It seems like small savings, but added together you could save 20-30 dollars at each trip to the market

- Shop around for bargains

- Do not live outside of your means

- Work with a credit counselor to get help in lowering your monthly expenses and get rid of your debt. NeighborImpact offers great classes, resources and one-on-one counseling by credit experts to help you get there.

These are just some of the things that you can do when beginning your financial goal setting plan. The steps to setting goals successfully don’t change, only the methods that you use to go about it. For example: when it is career wise, work to get noticed; for relationships, work on maintaining your intimacy or getting it back; in financial goal setting, work to save and invest money etc.

Review the following and plan saving goals for necessary household items:

Considering Purchasing Options

For first-time homeowners, it may make sense to buy used appliances, housewares, and lawn tools. The key is to take your time and do your research. You want to be sure that the used item is actually less expensive and reliable. Bend and Redmond Habitat ReStores are great resources. Ask Family Services to receive your Discount Card to receive 20% off your purchase.

Go slowly when buying items—even used items. Purchases that could be put off should be put off, at least until you have a clearer picture of your new expenses.

Appliances

- Research online and ask around to find out which brands are the most reliable.

- Consider buying used from a business or individual (but consider the cost of delivery and whether a warranty is available)

- Consider buying a floor model or scratch-and-dent item. Imperfections reduce prices.

Tip: A used appliance that lasts only a few years will still give you time to save for the model you really want.

Housewares

Let friends and family know you need certain items. They may have items gathering dust that they will give you or sell to you at a low cost.

Visit garage sales and flea markets. Inspect items carefully, then bargain over the price. Think creatively. A tablecloth from a yard sale could make a unique window treatment.

Motorized Items

-Be sure the item will start.

-Check the condition of important parts, such as the motor and blades.

-Request a test drive.

-Ask if the item comes with any paperwork, such as an owner’s manual.

-Ask a knowledgeable friend to come along.

Tip: Keep seasons in mind. There may be little need to buy a lawn mower or gardening tools in the late fall, which gives you time to research and save. A snow shovel, however, may be in order.

Pets

Most first-time homeowners are looking forward to owning their own home and bringing a new member to the family. The Habitat trust deed included with your Habitat loan documents, the CCR’s (covenant, conditions and restrictions) recorded on your home and/or the language on the Home Owners Association’s covenant, as well as the City Codes list detailed restrictions of the types of pets and how many are allowed per household. Please always refer to these documents before getting excited about moving forward with adopting or buying your new family member.

It is always helpful to include the cost of owning and caring for a pet in your monthly budget, as we know they could come to be a high initial payment depending if you adopt or buy; and down the road, whether you sign up for pet insurance, spay or neuter costs, food, license fee, vaccinations and unfortunately, emergency visits to the Vet.

Please follow this link to learn more about what considerations should you plan for when becoming a pet owner. There is a cool pet cost calculator in this article

Click to open & download assignment 6Making an Impressive First Impression

Adapted from McDonald Group Inc. article

Interviewing is stressful enough without having to answer dumb interview questions. Unfortunately, many interviewers, because of habit, lack of preparation time, poor training, or yes, even laziness, often ask dumb interview questions. Of those, one of the most challenging is the often used “Tell me about yourself?” interview opener.

What most candidates ask about this insipid interview question is “What do they want to know?”…they want to know about you, the candidate, as a potential employee.

They don’t want to know about your family, your last vacation, your hobbies, your religious beliefs, that you like the Cubs, or that you are a proud member of AA. Interviewers also think it is a sign of your lack of preparedness, improper or even rude for you to answer their “Tell me about yourself?” question with a question like “What would you like to know?”

If you are prepared or even seriously thinking about making a career change, you will have a prepared a thoughtful answer to the “Tell me about yourself?” question BEFORE you begin your interview.

As an example, I watched a candidate lose their dream job because he did not understand the importance of the simple “Tell me about yourself” question. The scenario was this: the candidate was a financial services professional and was interviewing for a higher level management position. The candidate had the ideal background and skill set and it seemed they were a perfect fit.

To start the interview, the candidate was asked the dreaded “Tell me about yourself?” question. Thinking this was an unimportant icebreaker question the candidate retorted, simply intending to cause an opening chuckle, “Well, as you can obviously see, I am 15-20 pounds overweight.” (He was only joking but a bit too honest!)

Yet, due to the impact this answer had on the interviewer/business owner, for all practical purposes, the interview was over as soon as the interviewers heard this answer. That “amusing” answer to what the candidate viewed as a seemingly harmless question convinced the employer that this potential manager had an image problem or low self-esteem problem.

The retort was just a joke…but not really. It was no joke to the candidate who lost the dream job. This candidate attempted to humorously break the ice, but the interviewers misinterpreted the response to the question and became convinced the candidate was not management material. This whole fiasco could have been avoided if the candidate had just been taught a very simple formula for answering this question. Yes, this is an unnecessary question with which to begin an interview, especially while holding your resume. However because clients open interviews with this question, candidates need to know how to respond to this question intelligently. This formula has worked wonders for hundreds of our candidates.

This would be an easy question if candidates answered with a prepared and well thought-out initial marketing statement of themselves and their skills which are applicable for the open job. While this sounds straightforward, few candidates are able to answer this question in an intelligent manner. Candidates must teach themselves to answer this question with a three-part, pre-planned marketing statement that can more or less be used from interview to interview.

A Personal Career Statement

Part One: A one sentence summary of your career history.

For example: “I am a Certified Nursing Assistant with 5 years of varied experience.” You get the picture. Your whole career needs to be condensed into one sentence that encapsulates the most important aspects of your career/jobs, the aspects that you want to leverage in order to make your next career step. Few candidates seem to be able to condense a career into one sentence, but it must, and can, be done. Record this answer in Assignment Section 7

Part Two: A one, maybe two sentence summary, of a single accomplishment that you are proud of that will also capture the potential employer’s attention.

This sentence immediately follows your initial career summary sentence from above. This accomplishment should be one that the employer will be interested in hearing, one that is easily explained or illustrated, and one that clearly highlights a bottom line impact.

When done correctly this will build the interviewer’s interest about the accomplishment so that they will inquire further, giving you an opportunity to further discuss your significant career success. For example, “I was able to save my last employer $500 per month by suggesting a scheduling modification to the current system”. Write the answer in Assignment Section 7.

Part Three: A one sentence summary of specifically what you want to do next in your career or position.

The reason this third part is so difficult is that the summary needs to specifically address what you want to do next AND it needs to change from interview to interview to make sure the summary matches exactly the position you will be interviewing for with the INDIVIDUAL employers.

For example, two final sentences, which were used for two different employers, are below.

The first business is a small Care Facility that also employs specialty doctors and technical staff that is advertising to hire an experienced CNA.

- “For the next step in my career, I would like to move away from in-home Nursing Assistant care and work in a care facility where I can use my skills in a more clinical environment”.

But for a second employer, this sentence could be altered because of the employers multiple locations and differing opportunities:

- “For the next step in my career, I would like to find myself as a manager of a strong nursing assistance program, such as yours, while still working part time with clients so that I continue to stay in touch with the industry. I would love to apply my management and scheduling skills to this growing nursing team.”

These were two very different endings that perfectly matched two very different employer needs.

Clearly you can see how the difference between businesses can direct your answer to align with the opportunities. With some simple revising, the candidate made sure that each employer heard that they were interested in doing exactly what the employer was interested in for this open opportunity. The revising is what makes the third piece fluid and sometimes challenging as candidates do not always see the need for being this specific from job interview to job interview. Most tend to generalize, hoping that a shotgun approach will work. But it is the rifle sharpshooters, those who get specific in what they want from interview to interview, who get the best results.

With some simple planning BEFORE an interview, you will quickly realize the benefit of a targeted third sentence in these pre-planned opening statements as employers feel you are perfectly suited to do just the job they are interviewing you for.

Candidates who take the time to create their own Personal Marketing Statement significantly improve their initial verbal impression and get their interview off to a confident and focused start – one that will hopefully lead to follow-up interviews.

Click to open & download assignment 7When Construction Begins

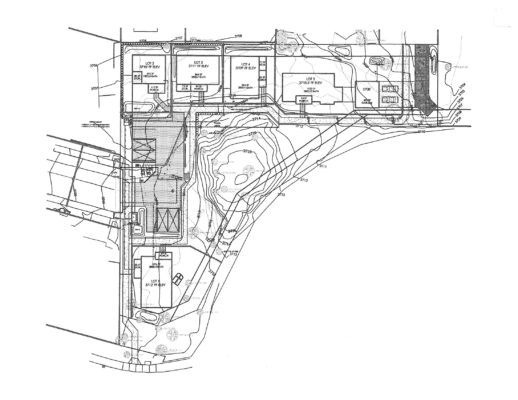

Habitat works with local architects, sometimes on a volunteer basis, to design each house. Once the architect and other authorities are satisfied with the design of the home, Habitat will take the plans to the city for approval. The timeline can vary greatly for approval for each home, typically ranging from 3 to 5+ weeks. Once the plans have been approved and funding has been secured for a home, we will meet with the prospective homeowner and then begin construction.

Construction Schedule

On average, new home construction takes about 18-20 weeks to build, assuming no outside influences. However, each home’s schedule will vary because of one or many of the following: work occurring on multiple sites, unforeseen weather conditions, volunteer fluctuation, financial limitations, and material and contractor availability. Rehabilitation projects are even more variable – work may take anywhere from 2-6 months based on the work to be completed and other variables similar to new homes. Home Services will be providing updates regarding construction schedules on a quarterly basis. Specific dates that will be shared with future homeowners are: Building plans approval date, Plan review date, Dry-wall completion date.

The Plan review is a meeting scheduled between the Construction Director and the future homeowner. This meeting is scheduled after Habitat receives approval on building plans from the respective city (Bend or Redmond), typically before the ground-breaking. Drywall completion means we are about 8 weeks out to finishing up your home and kicks-in getting you ready to apply for your home loan.

Typically, a family is assigned to a property (home address) when they are about 75% complete with all program requirements.

Green Building

Habitat for Humanity is making great strides to reduce material consumption by employing a variety of green building techniques. Green Building uses a whole systems approach to design, construction and operation of buildings, attempting to conserve natural resources and reduce the demand on energy while improving indoor air quality. With each home built, Habitat evaluates the environmental and economic costs and benefits of each stage of construction.

With help from experts and guidance from organizations working on standardizing the green building industry, we have formulated a plan for building better homes.

Habitat has considered the following topics and created Best Management Practices for each. Although not everyone can be incorporated into each home, Habitat has guidelines for implementing as many of these practices as possible:

Site Selection Structural Materials and Framing

Appliances Site Conditions

Windows and Doors Electrical

Foundation Mechanical Systems

Landscaping Roofing

Renewable Energy Systems Finish Materials

Plumbing Indoor Air Quality

Insulation Building Operations and Maintenance

Specific Home Details

Building Size and Location: The size of your home reduces environmental impact by limiting the amount of land disturbance per home, the amount of materials, energy and other resources necessary. When possible, the location facilitates walking to schools, shops and other amenities while creating a neighborhood feel for all homeowners.

Insulation: Habitat exceeds insulation codes and builds highly efficient homes that retain heat in the winter and remain cool in the summer. Advanced framing techniques allow for more insulation in the walls and raised-heel trusses in the roof allow for more attic insulation where most heat escapes from homes. Increased insulation and air sealing techniques help reduce monthly energy bills.

Home Orientation/Passive Heating: By orienting homes South-East, more natural sunlight can enter the home during cold weather months and heat the living space “passively.”

Passive Cooling: In the summer, the sun is higher in the sky and sunlight is blocked from entering the main living space by the extended eaves. Cross ventilation is another passive cooling strategy that involves strategically opening windows in the evening to allow for the cool night air to flow through the home. Windows should remain closed during the day to keep the hot air out.

Tankless Water Heater: This alternative to a traditional hot water heater saves space, money and energy. This unit heats water once hot water is turned on somewhere in the home. This is also called an “on-demand” hot water heater; there is no need to maintain hot water in a traditional water heater tank.

Radiant Floor Heating: Radiant floor heating is a very efficient way to heat your home through the winter months. Hot water is circulated through tubing just below the floor in a continual loop. The heat from the water rises into the conditioned space and warms the home. Homes typically have 2 heating zones, one for living areas and another for bedrooms.

Indoor Air Quality: Low VOC paint and finishes, natural materials and urea-formaldehyde free products are used. Habitat also provides mechanical means of exhausting moist/damp air, significantly reducing the chances of mold and/or mildew and facilitates air circulation throughout the home.

Appliances and Fixtures: Habitat provides Energy Star rated appliances and low-flow water fixtures (refrigerator, range, toilets, faucets, showers).

Landscaping: By using native plants that require little water and maintenance, it is easier to keep your yard looking great. It also reduces water bills and conserves this valuable resource.

Home Design: As is stated in the Home Design Policy “A family’s home assignment depends only on two considerations: The number of bedrooms a family requires (at time of application/acceptance into the Partnership program) and the sizes and types of homes are currently available or will be available in the future on planned sites”.

Type of Construction

Following is a listing of the types of construction and components that normally will be used; however, alternative types of construction may be considered:

Attic

- Attic access shall be provided

Bathrooms

- Typically, 2 bathrooms provided

- Standard toilet

- Shower (master) or tub/shower combo with shower rod

- Externally vented exhaust fan

- Towel bars, mirror, toilet paper holder

- Vanity sink & faucet

- Obscured glass in window

Cabinets / Counter-tops

- Kitchen lower and upper cabinets are provided.

- Bathroom vanities are provided

- Laminate counter tops installed on-site

Closets

- One shelf and clothes rod shall be provided for each closet

- One shelf is provided in the washer/ dryer area

Doors

- Steel exterior doors

- Lock set and deadbolt for all exterior doors, keyed alike

- Installed hollow core interior doors

- Bedroom closet doors shall be hollow core, 6 panel, bi-fold or by-pass doors

- Locking bathroom and master suite doors

Entrance

- Covered front porch, if the site plan allows

- Stoop/pad shall be provided at all exterior doors; minimum 3’ x 3’

Exterior Walls

- Cement lap siding, board and batt system

- Fascia and trim boards are wood

Flooring

- PVC core laminate flooring is typically installed throughout the home (incl.: baths, bedrooms, entry, kitchen)

- Carpeting is installed on stairs and 2nd floor bedrooms (if applicable)

Framing

- Stem wall and floor joists

- Wood frame (2’x6′) exterior walls

- Roof trusses

Heating, Ventilation and Air Conditioning

- In floor radiant heat system will be installed

- Ceiling fans are installed in the main living area and prewired in all bedrooms

Insulation

- R-24 exterior wall batt insulation

- R-49 attic blown-in insulation

- R-38 underfloor insulation

- Air sealing with spray foam and caulking

Interior Walls / Ceilings

- Gypsum wallboard installed on all walls and ceilings

- All surfaces are textured, primed and painted

Kitchen Equipment & Appliances

- 18 cubic ft. Whirlpool refrigerator/freezer (white)

- 30-inch Whirlpool gas range (white)

- Exhaust hood provided or owner can purchase a micro-hood combo. Note: Construction needs to know if family will be using a micro-hood combo to order the right cabinet configuration

- Electrical circuit installed for future microwave (homeowner must notify BRHFH)

- Double stainless steel sink with faucet and garbage disposal

Note on Appliances

If purchasing your own appliances, please let the Homeowner Services Department Staff know if they have measurements that are different from the standard appliances supplied by Whirlpool during the Plan Design Review meeting and/or before the framing stage.

Note: Please wait until post-purchase (Dedication and Closing) to install your own appliances. If you will not be using the supplied appliances, Habitat will pick them up after the home has passed final inspection for use in another Habitat home.

Landscaping

- Xeriscaping (native plants, low water) will be used wherever possible

- Provide 1 exterior hose bib per house

- Wooded/mature lots shall be cleared only to the extent necessary. Care shall be taken to leave the maximum number of the existing trees and other native vegetation.

Lighting / Electrical Supply and Wiring

- 200 amp electrical service

- Wiring for TV in living room and all bedrooms

- Wiring shall be provided for phone jacks in the kitchen and master bedroom

- Wiring will be provided for a dishwasher (dishwasher not provided)

- Interior and exterior lights and outlets will be provided per code

- Smoke alarm/carbon monoxide detector and smoke alarms will be provided per code

- Freezer circuit wired in garage

Roof

- Roof pitch is typically 5/12 or 6/12

- Composite architectural shingles

- Continuous ridge vents shall be provided

Washer / Dryer Space

- An area will be provided for installation of a washer and dryer; stacked units may be required for most 2 bedroom homes/townhomes

- Water supply and drain plumbing shall be provided for the washer

- Appropriate electrical receptacles shall be provided for both appliances

- Dryer vent ducting to the home exterior is provided

- Gas source at dryer

- A shelf or other suitable storage means shall be provided for supplies

- Washers and dryers are not provided by Habitat

Water Heating

- Tankless water heater is provided

Windows

- Bedroom windows must meet egress requirements

- Windows will be U=0.30 rated, double-paned vinyl frames

- Windows shall be single hung, horizontal sliders, or fixed pane

- Screens shall be provided for operable windows

Window Coverings

- Hunter Douglas window coverings will be provided for all bedrooms

- Note: Partner Family will need to provide window coverings for other rooms, if desired.

Walkway

- A walkway shall lead from the driveway to the nearest entrance

Exclusions

Certain features and amenities must be excluded from Habitat homes. These exclusions do not detract from the basic livability of the houses. Excluded features include but are not limited to:

- Freezer

- Dishwasher

- Washer/Dryer

- Rain gutters for entire home

- Fences (unless required in some cases)

Exceptions to Criteria

Criteria set down in this policy are intended to define the basic Habitat home. Exceptions will be allowed for the following reasons:

- Materials or equipment of equal or higher quality are donated with no financial impact on Habitat or the homeowner

- Safety or municipal codes require changes

- Special needs related to the health or well-being of the homeowner and/or family members

- Other reasons approved by the Executive Director

Modification to Criteria

Bend Redmond Habitat home building criteria shall be reviewed by the Construction Committee at periodic intervals, not to exceed one year. Any changes shall be recommended to the Board of Directors.

ADA Access / Special Needs

If you require any special accommodations please let the Homeowner Services Department Staff know as soon as possible.

Rehabilitated / Renovated Homes

There will be instances where Habitat will be able to purchase an existing home that needs to be updated/weatherized that will then be resold to a new Habitat homeowner. These homes will be evaluated, both from a systems’ functionality and a performance perspective, then retrofitted with energy savings measures and updated based upon the results of the evaluations. Examples of this work are: adding attic insulation, repairing and replacing underfloor insulation, performing air sealing, replacing water heaters, and replacing electrical breakers. Energy Star rated appliances, typically a refrigerator and range, will be installed. Whenever funding is available, the home may have renewable resource systems installed (i.e. solar thermal, solar PV).

Necessary repairs will be made to the home attempting to return it to “like new” condition, all the while maintaining the affordability of the home for the eventual homeowner. Depending upon the condition of the home, the repair work will range from minor drywall repairs and interior and exterior painting to window and door replacement, new roofing, new flooring, and equipment replacement.

Please Read the Following Sections Carefully!!!

Remember:

The Habitat Construction Committee takes the family size and make up into consideration when planning each build. The number of bedrooms and bathrooms is specifically chosen for each family in accordance with Habitat’s guidelines and are non-negotiable.

Habitat follows a specific design criterion to help in standardizing the homes. This helps with keeping costs low and makes sure each homeowner receives the same end result: a clean, safe, affordable home. Habitat houses are bound to contain differences, due to family size, donations available, building codes, and other matters beyond the control of Habitat.

Upgrades or Changes to Habitat Homes While Being Built

The following policy was accepted by the Bend Area Habitat for Humanity Board of Directors at their December 16, 1998 meeting:

“No upgrades to the new Habitat homes are to be allowed for families while Habitat is in the process of building their new home.”

In other words, the plans that are approved by the City of Bend or Redmond, are to be followed specifically as drawn. After the home has been legally transferred to the Habitat homeowner, the Executive Director has always been willing to entertain a request for construction changes as long as the project meets City of Bend, or Redmond, requirements. Prior approval must be received prior to any changes.

You will not be allowed to move any personal belongings on to the property until the closing documents have been signed and recorded.

Expectations as a Habitat Homeowner

Maintenance of your home is important. We consistently struggle to fight the stigma that Habitat homeowners don’t take care or pride in their homes once they move in, resulting in the loss of appraised value of their neighbor’s home. Please let us know if you need assistance learning how to care for, or repair something as it is our goal to prepare you as best as we can.

Donations to future homes

We hear you get a lot of questions from folks who want to help when they find out you are buying a Habitat home. We bet it can be difficult to manage everyone wanting to help. Here are a couple of answers you can give them:

Because Habitat is not a private home builder, and they have unique requirements for their Earth Advantage and Net Zero certifications, they do not always take in-kind donations. However, you may contact their Director of Construction, who can help determine if it is something they can use. Thank you for thinking of me/us”.

Regarding being on-site/inside your future home, without the presence of Habitat Staff and before purchase date

Because we have liabilities, we cannot have you on site without a staff person before you purchase the home. We have given occasional special permission for home/site cleaning but this is still a risk for us. Although families and other volunteers have signed our waivers, we can sometimes allow for this to happen. However, we absolutely cannot have other guests on site who have not signed waivers. Always, always there needs to be a Habitat staff person present. We have been slack on this at times, but we really need to follow our policy for the safety of everyone.

Click to Open & download assignment 8Your Neighborhood

Do you want to live in a neighborhood where you feel safe and connected to others? This, and other aspects of neighborhood life, can impact both your level of happiness and stress. Click on the link to watch a video on how Bend Habitat (now, Bend-Redmond Habitat) creates community in Central Oregon, one home at a time.

What Does It Mean to You to Be a Good Neighbor?

By definition, being a good neighbor means having selfless concern for the complete well-being of people around you.

When you and your neighbors hold a conversation, you might notice a way you could be a better neighbor and friend to them. For instance, if they mention having car troubles, you might offer to drive them to work, or drive their kids to school… If they mention that they have been feeling sick, offer to make them a meal to allow them ore rest. Invite them to contribute to your garage sales, have them over for tea, or offer to babysit their kids/pets while they’re away. They’ll do the same for you. Humble offerings like these show your neighbor that you are investing in the relationship, not simply wanting something in return.

Things to Consider…

- Consider your neighbors’ lifestyle. What do they do for a living, what their schedules might be like, and so on? Sometimes, you can remedy problems before they even start; for example, if they work nights, quiet mornings will be important for them. If they have young children, quiet evenings will be very important to them. Similarly, give them information that’ll help them be more considerate of your lifestyle. If you do a lot of yard work, or if your teenage son plays the drums, let them know in advance and mention that if it’s getting too loud, they shouldn’t hesitate to let you know.

- Keep your dog on a leash. If your dog has a habit of running rampant on your neighbors’ lawns, especially if they have a cat or a dog of their own, leash your dog or find another way to control it. Make sure to clean up after your dog, both in your yard and your neighbors’. If you have a particularly noisy dog, this may also become a source of contention for your neighbor. Put yourself in their shoes and imagine how upset you’d be if you or perhaps your newborn was woken from a much-needed nap by the sudden yapping of a nearby dog. If you have problems controlling your dog’s barking or whining, consider seeking advice from your local vet or a local animal organization.

- Parking Etiquette. When you park your vehicle, be sure not to block anyone’s access, or make them have to pull out of a very tight spot. Don’t over-rev the engine of your car or motorcycle early in the morning or late at night. Park in front of your home, not theirs. Avoid slamming your doors or shining your headlights into your neighbor’s windows late at night.

- Alert your neighbor to parties. If you’re planning a party, be sure to give your neighbors plenty of warning, letting them know when it’s going to start and how long you expect it to go on. Leave them a telephone number to contact if they need to ask you to turn it down. If you get on well with your neighbors, why not invite them too? When it comes to the party itself, stick to your agreed arrangements and ask your guests to be considerate when leaving.

- Keep your yard tidy. Weed your yard or garden regularly, because the presence of weeds in your yard is not only unsightly but can also spread to your neighbor’s yard. Mow your lawn regularly and keep your flowers, trees and bushes trimmed appropriately. Put equipment away as soon as you’re finished with it. Ask if your neighbor has chemical sensitivities, small children or pets before applying pesticides.

- Put garbage out on the right day. Only put your garbage out on the day it’s due for collection. If you accidentally miss the collection, bring it back onto your property immediately and try to contain it well. Garbage can attract vermin, insects, and other pests, and is also unsightly.

Have you ever had a terrible experience as a new neighbor? What made it difficult?

Have you had a great experience as a new neighbor? What did you learn from it?

Remember: “There are no strangers here; only friends you haven’t met yet” ~ William Butler Yeats

While you may not be able to change the neighborhood in which you live, you can change the experience you have in your own neighborhood by getting more involved with those around you and taking pride in the area in which you live. The following are some ideas and resources that can help you to feel more at home in your neighborhood:

- Get Out More: If you live in a generally safe area, take a morning or evening walk. It’s a great stress reliever that also allows you to get to know many of your neighbors, get an understanding of who lives where, and feel more at home in your surroundings.

- Smile: It’s simple enough, but if you’re not in the habit of smiling and giving a friendly hello to the people you encounter in your neighborhood, it’s a good habit to start. While not everyone will return the friendliness immediately, it’s a quick way to get to know people and build relationships, even if you’ve lived close for years and haven’t really said much to one another.

- Talk to Your Elders: The more veteran members of the neighborhood often have the inside scoop on the neighborhood. You may be surprised at how much you can learn if you stop to take the time to talk to the sweet old lady at the end of the block.

- Start a Neighborhood Watch Program: To feel safer at night and build a sense of community at the same time, starting a neighborhood watch program is a great idea.

- If you hear of any neighborhood news (events, crimes, special garbage pickups, special event parking restrictions, etc.) give them a heads-up by e-mail.

- If you have a snow blower and they don’t, spend that extra 60 seconds to clear their walkway. It will save them 60 minutes of hard work and they’ll be grateful!

- Be nice to your new neighbors- When someone new is moving next to you, Welcome them. They will be thankful to you for a jug of lemonade.

So, What Else Can You Do?